|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

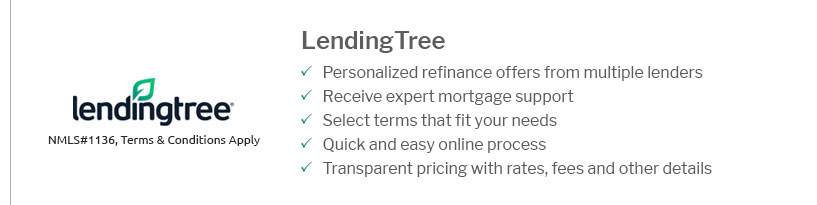

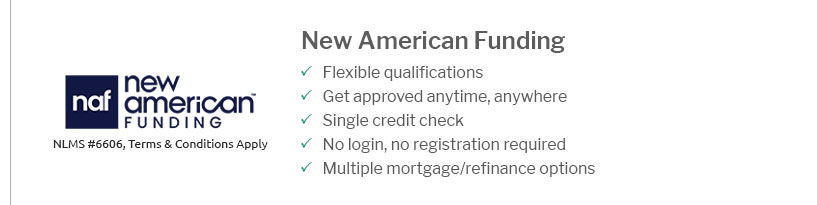

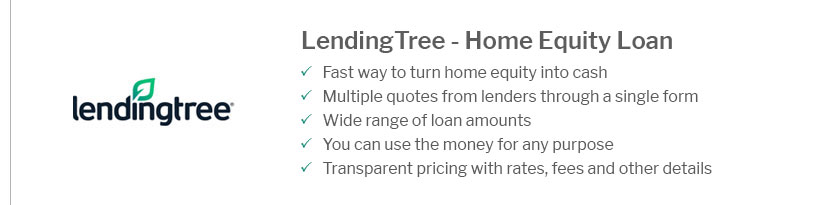

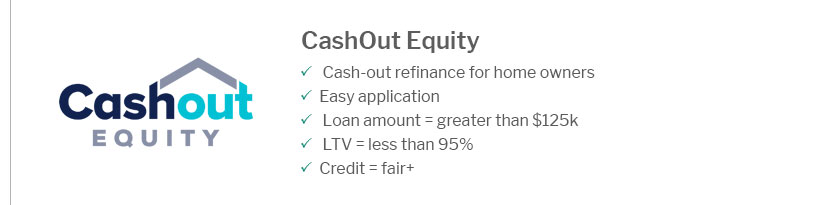

Exploring the Current Lowest Mortgage Rates: What You Need to KnowUnderstanding Mortgage RatesMortgage rates can significantly impact the cost of buying a home, and staying informed about the whats a low mortgage rate can help you make smarter financial decisions. This article will help you understand the factors affecting these rates and how to secure the best deal. Factors Influencing Mortgage RatesEconomic IndicatorsEconomic factors such as inflation, employment rates, and economic growth play a crucial role in determining mortgage rates. When the economy is strong, rates tend to increase. Credit Score ImpactYour credit score is a critical factor. A higher score typically means a lower interest rate. It's advisable to check your credit report and resolve any issues before applying for a mortgage. Comparing Popular Mortgage Options

Understanding the differences between these options can help you decide which is best for your financial situation. Finding the Best Mortgage RatesTo find the most competitive rates, it's crucial to compare offers from various home financing companies near me. Be sure to consider the terms and conditions associated with each offer. FAQs About Mortgage Rateshttps://www.mortgagenewsdaily.com/mortgage-rates

lowest average level since early October 2024. If it's not already clear ... https://www.zillow.com/mortgage-rates/

The current average 30-year fixed mortgage rate climbed 10 basis points from 6.69% to 6.79% on Monday, Zillow announced. The 30-year fixed mortgage rate on ... https://money.usnews.com/loans/rates/mortgages/mortgage-rates

Average Mortgage Rates, Daily ; 30 Year Fixed. 6.827%. 6.831% ; 20 Year Fixed. 6.597%. 6.602% ; 15 Year Fixed. 5.954%. 5.96% ; 10 Year Fixed. 5.699%. 5.713%.

|

|---|